General informations

| Title | On the Nexus Between Economic Growth and Bank-based Financial Development: Evidence from Morocco |

| Publication | Middle East Development Journal |

| Citation | Ahmed Kchikeche & Ouafaà Khallouk (2021) On the nexus between economic growth and bank-based financial development: evidence from Morocco, Middle East Development Journal, 13:2, 245-264, DOI: 10.1080/17938120.2021.1930830 |

| Links | Publishers’ Link – Open Access link (MPRA) |

One sentence summary

We provide robust evidence that developing the banking sector in Morocco helps grow the economy in both the short and the long run.

Abstract

In this paper, we investigate the causal link between bank-based financial development and economic growth in Morocco between 2003 and 2018 using a vector autoregression framework. We test for causality between economic growth and four different measures of bank-based financial development in both the short and the long run.

Our results show that bank-based financial development causes economic growth in the short and the long run. Moreover, our results show that economic growth only causes bank-based financial development in the long run. At last, we show that the Moroccan banking sector’s integration with the international financial markets only affects the causal link between economic growth and bank-based financial development by providing short-run liquidity to Moroccan banks.

Based on these results, barriers to the financial development of the Moroccan banking sector should be investigated and public policy should focus on designing appropriate policies and programs to alleviate these barriers in order to stimulate the growth of the Moroccan economy.

Non-technical summary

1. The research problem

Which came first: the chicken or the egg? This is the kind of question that we tackled in this publication.

For more than a hundred years, Macroeconomist (economists who are more interested in what drives the whole economy instead of focusing on understanding individual behavior) have pondered the relationship between the growth of the “real” economy, defined by the rise in the production of goods and services over time, and the development of the financial sector, comprised of banks and other financial institutions.

Setting this debate is far from straightforward. It requires examining whether economic growth and financial development are linked. If such a link exists, the next stage of the research consists of determining the direction of this link. Does economic growth cause financial development? Does financial development cause economic growth? Or does the link go both ways and the variables cause each other simultaneously?

Why is this important? Simply because policymakers who aim to help the economy grow need to know if they can achieve this by promoting the development of the financial sector.

An important caveat before we can go further is that the answer to the research problem changes from one country to another, depending mainly on each country’s stage of economic and financial development.

2. Some context

The Moroccan economy has advanced significantly in the last decades; economic growth is less volatile and more sustained, and the financial sector is more sophisticated than before. However, despite these advancements, the economy grows at a slow, declining pace; growth that is not concentrated is the most beneficial sector that can generate stable, high-quality employment.

On the other hand, the financial sector is unable to “finance” the economy adequately. As a developing country, Morroco relies on banks to finance the needs of firms and households. A lack of development in the banking sector impedes this financing and harms economic growth. Hence, the importance of this study is that it aims to establish the empirical link between these two dimensions.

3. Methods

We gathered data on the Moroccan economy between 2003 and 2018.

To measure economic growth, we used the non-agricultural gross domestic product, the sum of all production of goods and services from all the sectors of the economy (excluding the agricultural sector) in each year. We excluded the agricultural sector from our calculations of economic growth because the production of this underdeveloped sector is simply unpredictable. As economists, we are usually interested in what can be affected through economic policy. Unfortunately, agricultural production in Morocco is affected more by rainfall and climatic production than by the decisions and efforts of farmers and policymakers, which make agricultural production a poor measure of economic growth.

Measuring bank-based financial development is also a challenge. Scholars are not in agreement on which measure to use. To solve this problem, we surveyed the studies on the subject and selected the three most used indicators: Total assets, Total deposits, and credit to the private sector. Furthermore, we constructed our measure of bank-based financial development using the principal component analysis statistical technique.

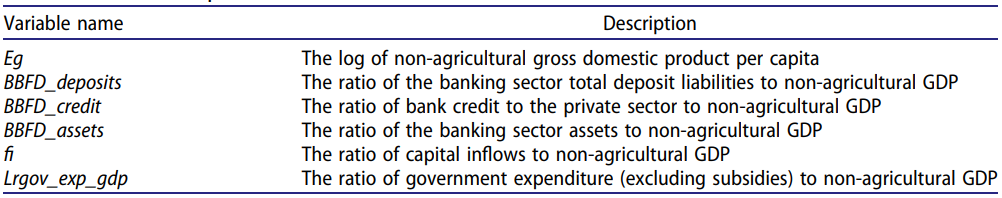

To answer our research question, we estimated a Vector Error Correction Model (VECM) that allowed us to test for causality in the short and the long run. We estimated four models, each containing four variables. In addition to our measures of economic growth (non-agricultural GDP) and bank-based financial development (Total bank assets, total bank deposits, and total credit to the private sector, all as a percentage of non-agricultural GDP), our models include two control variables: total government expenditure (excluding subsidies) and capital inflows. The description of all these variables is shown in Table 2 below.

4. Results and conclusions

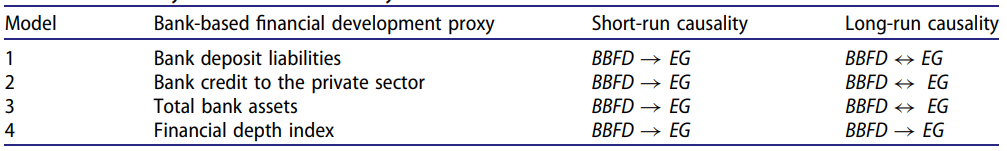

The results of the causality tests are shown in Table 3.

These results show a robust causal effect of bank-based financial development on non-agricultural economic growth in Morocco during the study period in both the short and the long run. The robustness of our results is shown by the fact that they do not change when we change our measure of bank-based financial development.

On the other hand, we show no causal impact of economic growth on bank-based financial development in the short run. Economic growth only causes bank-based financial development in the long run (according to 3/4 models). Thus, the causality between bank-based financial development and economic growth is unidirectional in the short run and bi-directional in the long run.

5. Implications, limits, and work yet to be done.

So, what does this all mean?

Well, if developing the banking sector is important for economic growth, then the lack thereof is, in the best of cases, a substantial loss of economic growth potential for the Moroccan economy.

In practice, knowing the barriers to developing and alleviating the banking sector would help promote economic growth in Morocco. In light of our results and the observed decline in economic growth and the development of the banking sector, the need to investigate the decline in bank credit growth to the Moroccan economy imposes itself. Determining the cause of the problem would help policymakers design the appropriate tools for intervention. Therefore, more research needs to be conducted to investigate the determinants of bank credit dynamics in Morocco (foreshadowing 😊).

What could I have done better? A lot.

First, I only measured one dimension of bank-based financial development (Depth). Other dimensions, such as the ease of access to, the efficiency and stability of the banking sector, would improve our understanding of bank-based financial development. Second, the impact of bank-based financial development on economic growth could also be non-linear. There could be a threshold beyond which this impact becomes weaker, insignificant, or even detrimental.

Third, a more comprehensive study on the MENA region could also be an excellent follow-up to this study. I’m open to collaboration on this subject. Please contact me if you have any ideas.